Not everyone wants to wait until they turn 60 or 65 to retire. In fact, people are retiring in their 30s and 40s. We are not talking about those who inherited big or won the lottery. We are talking about individuals who earn average incomes and retire much earlier than the traditional retirement age. They are part of the movement called Lean FI.

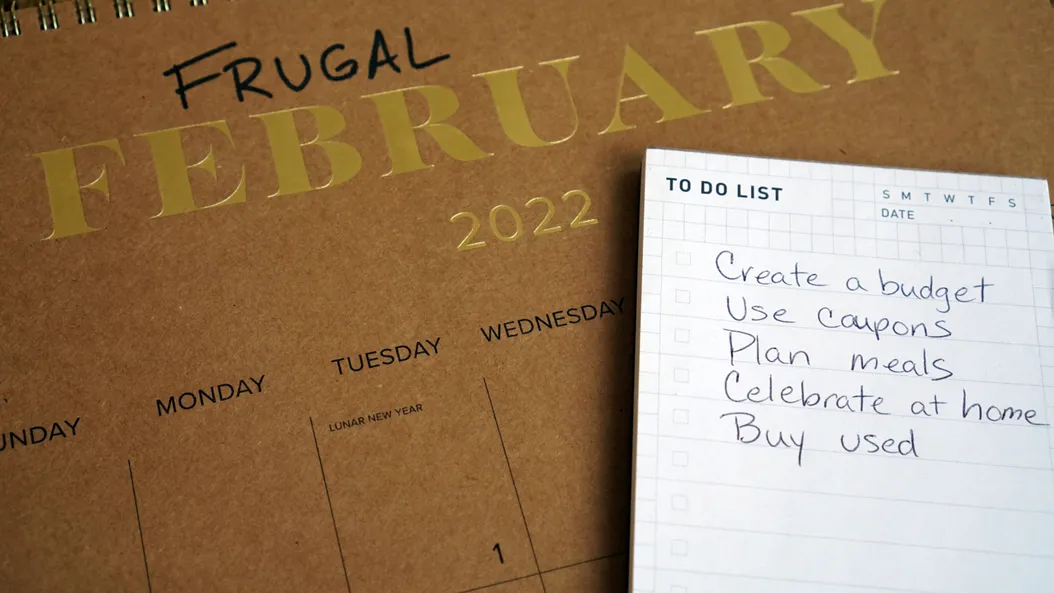

Lean FI focuses on achieving financial independence and retiring early by living way below their means, adopting extreme frugalism and a savings rate of over 50%.

So, how does one retire so early with Lean FI?

In order to achieve any form of financial independence, it's necessary to live below your means. Lean FIRE is an extreme version of the FIRE (Financial Independence, Retire Early) movement, where individuals live well below their means and only cover basic necessities to achieve their financial goals.

What needs to be saved and invested to achieve Lean FI?

Lean FI usually involves extreme frugality, and many sources discuss living on just 20K to 45K. However, this falls within the poverty wage range and may require living with parents or relocating to a different country (perhaps Geography FI).

Suppose you're not aiming for extreme frugality and want to consider more realistic expenses covering necessities in the US. In that case, it's essential to consider the variation from state to state. According to research conducted by SmartAsset, the annual expenses to cover necessities could range from $54,424 to $76,636 for families without kids and from $75,039 to $106,109 for families with two kids.

Based on the age at which you plan to stop working and assuming a withdrawal rate of 3 to 4%, you would need approximately $1,875,000.00 to $2,500,000 invested to achieve Lean FI in a state like West Virginia. With this amount, you should have enough saved to cover basic necessities. If you have social security coming in after age 62, your required amount could be lower. Additionally, the amount needed could be further reduced if you have paid off your mortgage or if your children are financially independent.

Is Lean FI for everyone?

It might not be suitable for you if you want to take vacations yearly or have kids and want to cover their educational expenses. If you want to leave funds behind in estate to generational wealth, Lean FI might not make the cut.

Sacrifices People Who Are Lean FIRE Or Want To Lean FIRE Make

Lean FI is an option if you only want to save up the minimum amount to cover basic necessities. However, being extremely frugal may be challenging and require significant sacrifices. If you are comfortable with a frugal lifestyle before and after retirement, then Lean FI could be a good choice.

If you are considering early retirement with Lean FI, you should also consider what you would do with all the time you'd have. You could work part-time (Barista FIRE, maybe) and use the income to afford things beyond your basic necessities.

Achieving Lean FIRE with ReachFI

Whatever your goals are to achieve Lean FI, input your expenses and income scenarios into ReachFI to explore your options. No matter your FIRE options, a financial plan is the first step toward achieving financial independence. Take that first step with ReachFI and create a financial plan to see what is possible.