Cash Flow Is King: The Hidden Force Behind Financial Freedom

When most people think about wealth, their minds drift to net worth, investment portfolios, or owning property. But if you ask any seasoned financial expert, they’ll tell you one often-overlooked metric tells the real story of your financial health: cash flow.

Cash flow, in simple terms, is the money that comes in and goes out of your life. It’s the stream of income, expenses, savings, and investments that defines your ability to not just survive, but thrive. Whether you’re pursuing FIRE (Financial Independence, Retire Early), saving for a big life change, or just trying to get a grip on your finances, mastering your personal cash flow is step one.

What Is Personal Cash Flow?

Personal cash flow is the net amount of money you have available after subtracting your expenses from your income. It’s what determines whether you’re living within your means, building wealth, or unknowingly sliding into debt.

Cash In (Income):

- Salary or wages

- Freelance or side hustle income

- Dividends and interest from investments

- Rental income

- Government benefits or pensions

Cash Out (Expenses):

- Rent or mortgage

- Utilities and groceries

- Subscriptions and memberships

- Transportation and childcare

- Debt repayments and insurance

When income exceeds expenses, you have positive cash flow. When expenses exceed income, you have negative cash flow—a red flag that demands attention.

Why Personal Cash Flow Matters for Financial Freedom and FIRE Planning

In the FIRE movement, controlling cash flow is everything. Why? Because early retirement hinges not just on your total savings, but on how much of your income you can consistently save and invest.

Let’s say you earn $100,000 a year. If your expenses are $90,000, your savings rate is just 10%. But if you manage to reduce expenses to $50,000, your savings rate jumps to 50%. That one change cuts decades off your time to financial independence.

ReachFi users who optimize their personal cash flow regularly discover:

- They can retire years earlier than they expected

- They have more options to reduce work hours or take career breaks

- They’re better protected from financial shocks like job loss or medical emergencies

Budgeting and Cash Flow: Two Sides of the Same Coin

Budgeting is the proactive cousin of cash flow management. When you budget well, you can predict, control, and optimize cash flow.

But while budgeting looks forward, cash flow shows what actually happened. That’s why tracking both gives a full picture:

- Did you stick to your planned expenses?

- Did you have an unexpected income bump?

- Did your actual savings match your target?

At ReachFi, we let you project and adjust future budgets so you can test “what if” scenarios—like cutting subscription costs, moving to a lower cost-of-living area, or even taking a year-long sabbatical.

How to Improve Your Personal Cash Flow

- Track Everything – Know what’s coming in and going out. Tools like ReachFi automate this so you don’t have to.

- Cut the Waste – Are you paying for things you don’t use? Start there.

- Increase Income – Negotiate your salary, take on freelance work, or monetize a hobby.

- Automate Savings – Set it and forget it. If it’s out of sight, it’s more likely to stay saved.

- Plan for Irregular Expenses – Budget annually, not just monthly. Things like travel, gifts, or car repairs sneak up.

Projecting Cash Flow into the Future

Most apps just track the present. But what if you could play forward your financial life?

That’s where ReachFi’s Play Forward feature comes in. It gives you a crystal ball into your financial future—where each year unfolds visually so you can see exactly how your choices impact your income, expenses, taxes, and net savings.

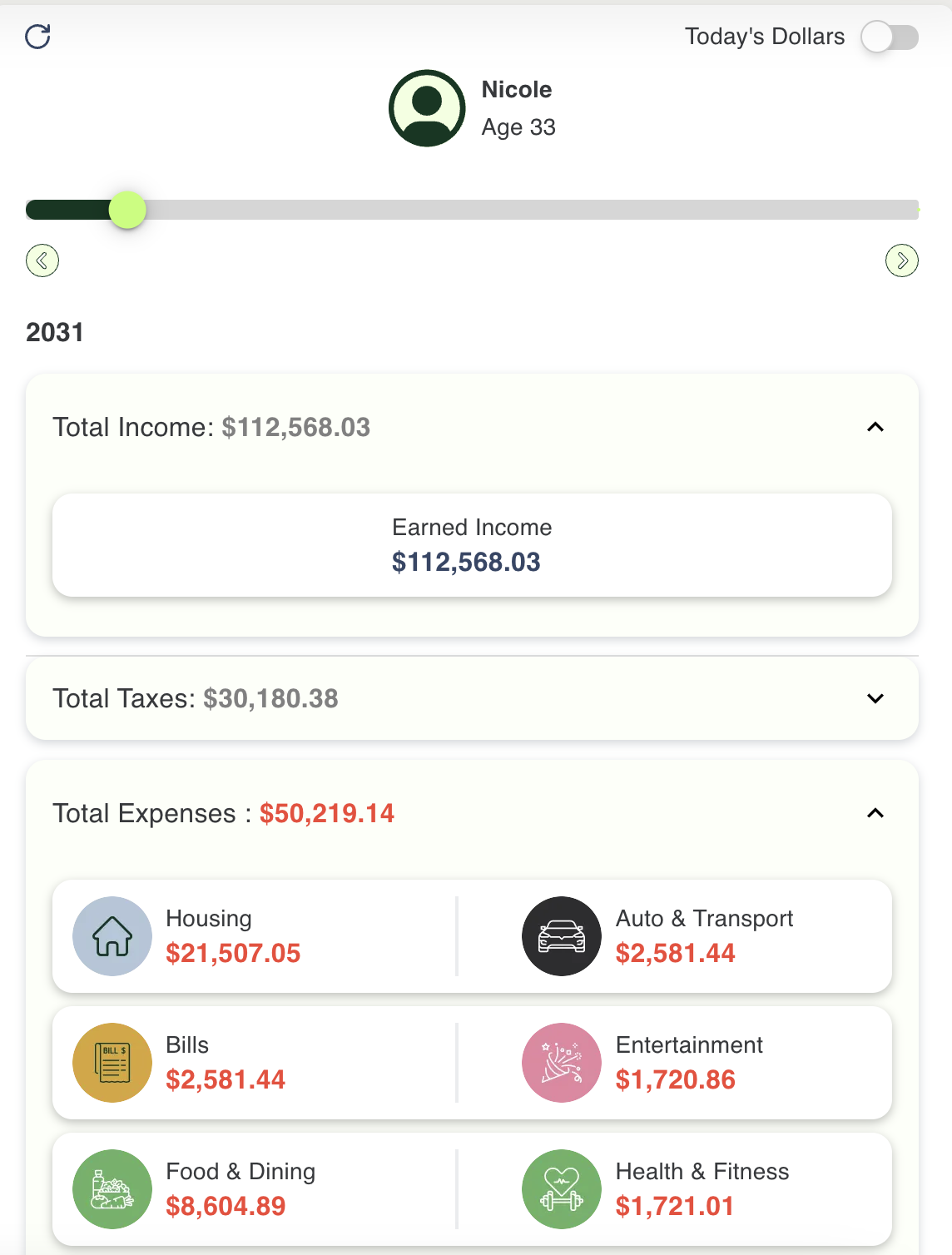

Take a look at the snapshot below from ReachFi’s projection view:

In this example, Nicole would be 33 years old in the year 2031. Her total income is projected to be $112,568.03, and after accounting for taxes of $30,180.38 and expenses totaling $50,219.14, she has a clear view of what’s left to invest or save. Every category is broken down—from Housing to Food & Dining—so she can spot where her money is going and where she can adjust.

With this tool, ReachFi users can:

- Navigate through each year using a simple slider

- Instantly see the tax impact of their income

- Drill into each expense category to identify savings opportunities

- Understand how today’s choices shape tomorrow’s outcomes

Whether you're planning for retirement, a sabbatical, or a major life change, ReachFi helps you simulate those moments before they happen—so you're always a step ahead.

Cash Flow and Your Financial Independence Number

Your FI number is how much you need to retire comfortably. But how you reach it—and how long it takes—depends entirely on your cash flow.

Improved cash flow means:

- Higher savings rate

- More investing power

- Faster wealth-building

- Greater financial resilience

The gap between your income and expenses is where freedom lives. Grow that gap, and you shrink the distance to independence.

Final Thoughts: Cash Flow Is the Real MVP

Net worth gets the headlines. But cash flow is the play-by-play. Without healthy personal cash flow, even a high income won’t lead to wealth. With it, you can turn modest earnings into lasting independence.

Ready to take control of your personal cash flow? Use ReachFi’s interactive cash flow projection tools to model your future and start your path to financial independence today.