Adding Earned Income in ReachFi

What is Earned Income?

Earned income refers to money received from active work, including:

✅ Salaries & wages from a full-time or part-time job

✅ Bonuses & commissions

✅ Tips

✅ Other employer-based compensation

Earned income is subject to payroll taxes and differs from passive income, self-employment income, or Social Security benefits, which are listed separately in ReachFI.

How to Add Earned Income in ReachFI

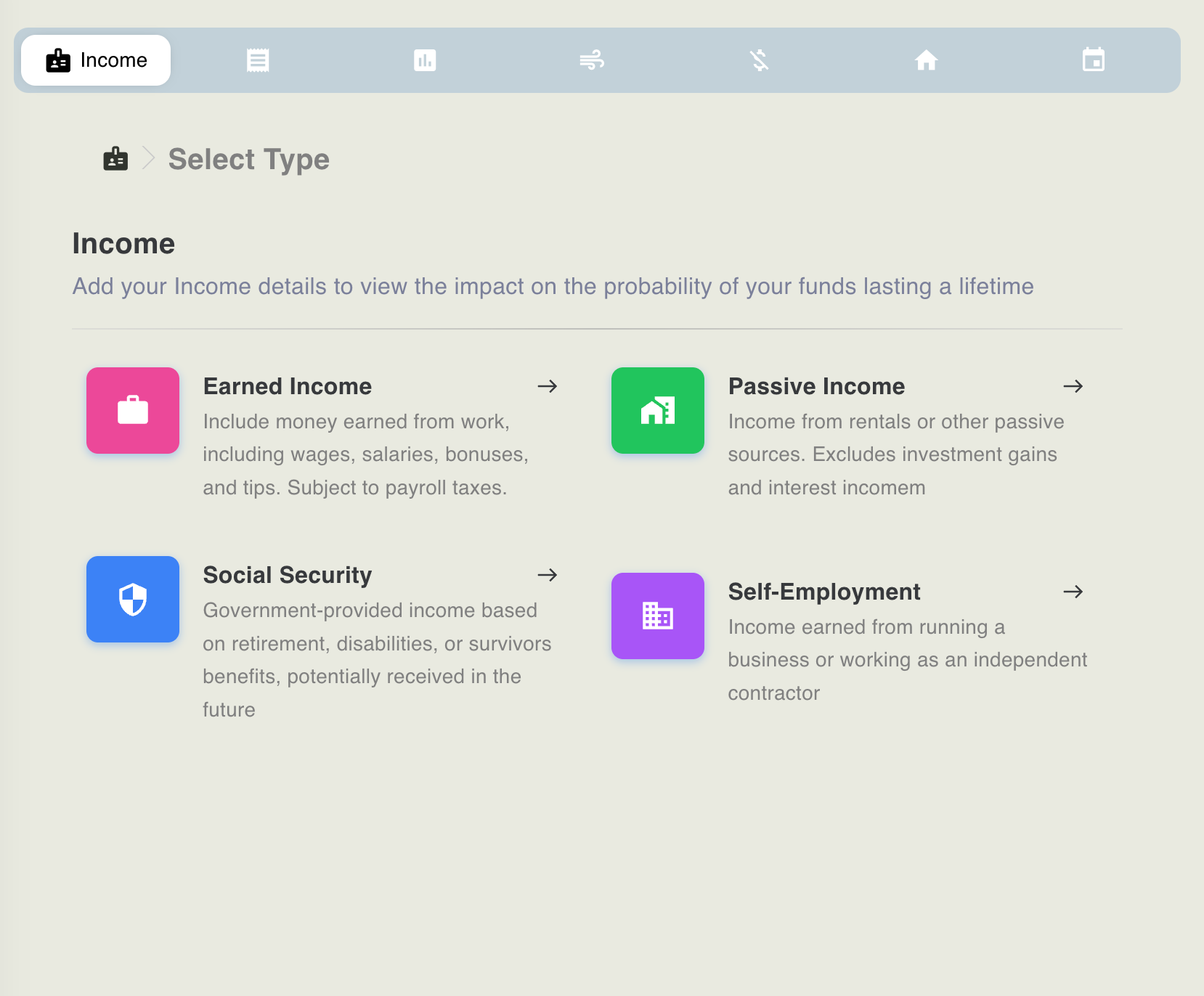

Step 1: Select the Income Type

- Navigate to the Income section.

- Choose Earned Income.

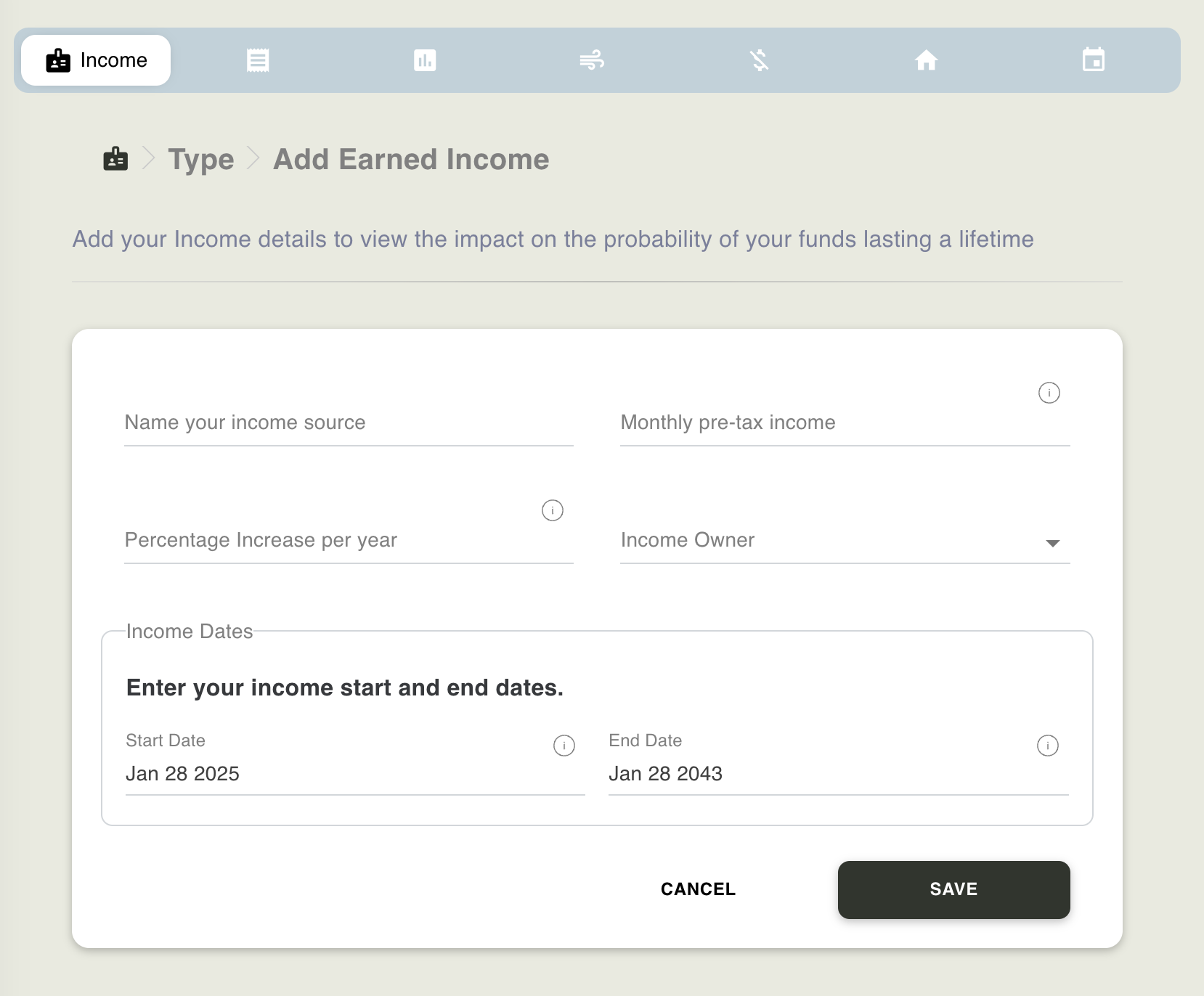

Step 2: Enter Your Income Details

- Name your income source → (Example: "Software Engineer Salary")

- Monthly pre-tax income → Enter your gross (before-tax) income amount.

- Percentage Increase per Year (Optional) → If you expect raises, enter the projected annual percentage increase (e.g., 3%).

- Income Owner → Select who this income belongs to.

Step 3: Define the Income Duration

- Start Date → The date you start earning this income.

- End Date → The date you expect this income to stop.

📌 Your End Date helps you explore financial scenarios like early retirement, career breaks, or transitioning to passive income.

Step 4: Save Your Income Entry

- Click SAVE to update your financial model.

- Click CANCEL to discard changes.

How Earned Income Helps You Plan for Retirement or a Career Change

By adjusting your End Date, you can explore different scenarios:

🔹 Testing When You Can Retire

- Set your end date to a traditional retirement age (e.g., 65 years old).

- Experiment with an earlier date to see if your savings can sustain an early retirement (FIRE movement).

🔹 Modeling a Career Break or Part-Time Work

- If you plan to pause working for a few years, enter a gap by adjusting your earned income timeline.

- You can also add a new income entry with a lower salary if you transition to part-time work later in life.

🔹 Understanding Financial Independence (FI)

- When your earned income stops, ReachFI calculates whether your investments and savings can cover your expenses.

- The system shows your projected withdrawal rates and probability of success.

- If your plan falls short, you may need to increase savings, adjust expenses, or extend work income.

Important Disclaimer

ReachFi provides financial modeling tools for scenario planning, but these projections rely on the data you input and assumptions about market returns. This is not financial advice. Consult a financial professional before making decisions about retirement, quitting a job, or adjusting income sources.